U1.01 — Classification of Businesses

Overview

When starting a business, one of the first decisions you’ll make is how it will be owned and structured — this is called the business classification or ownership structure.

The structure you choose affects control, how profits and risks are shared, how much tax you pay, and your legal responsibilities.

The main types of business ownership are:

👉 Sole Traders

👉 Partnerships

👉 Private Companies (Pty Ltd)

👉 Not-for-Profit Organisations

👉 Franchises

Each one has its own advantages, disadvantages, and level of legal responsibility.

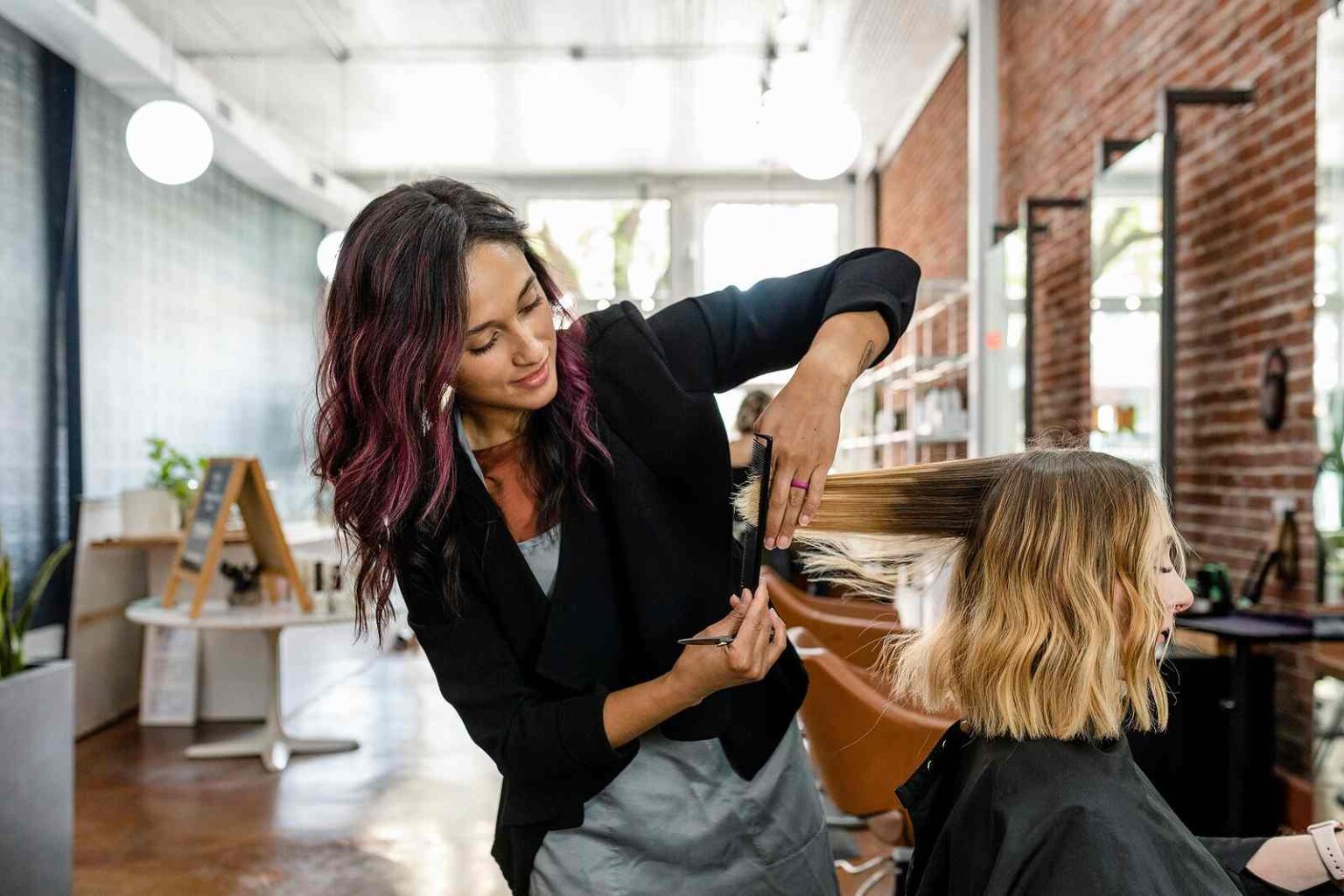

💼Sole Trader

Definition:

A sole trader is a business owned and operated by one person who makes all decisions and keeps all profits.

Summary:

This is the simplest and most common business type in WA. Sole traders often include local tradespeople, hairdressers, or café owners. They operate under their own name or a registered business name and report income through their personal tax return. However, the owner has unlimited liability, meaning they are personally responsible for all debts. It’s ideal for individuals wanting full control and flexibility with low start-up costs.

- Easy and cheap to set up.

- Full control and independence.

- Keeps all profits after tax.

- Simple tax and record-keeping.

- Easy to change structure later.

- Unlimited liability – personal assets are at risk.

- Limited access to finance.

- Heavy workload.

- Hard to take time off.

- Growth limited by owner’s capacity.

🤝Partnership

Definition:

A partnership is when two or more people (up to 20) own and operate a business together, sharing profits, losses, and responsibility.

Summary:

Partnerships are common in Perth among trades, health clinics, and creative studios. They’re not a separate legal entity, so partners can be personally liable for debts. It’s important to have a written partnership agreement under the Partnership Act 1895 (WA).

- Easy and low-cost to start.

- Shared workload and responsibilities.

- Combined financial resources and expertise.

- More ideas and problem-solving power.

- Mutual support between partners.

- Unlimited liability shared between partners.

- Conflicts can damage the business.

- Profits must be divided.

- Partners bound by each other’s actions.

- Hard to dissolve or change ownership.

Kojonup Agricultural Supplies — a partnership servicing the Great Southern farming community since 1986.

🏗️Private Company (Pty Ltd)

Definition:

A private company (Proprietary Limited or Pty Ltd) is a separate legal entity that can own assets, enter contracts, and be sued. It’s owned by shareholders and managed by directors.

Summary:

This structure is common in WA for SMEs that are expanding, for example in the construction idustry or tech start ups. Shareholders have limited liability, protecting their personal assets. Registered with ASIC and governed by the Corporations Act 2001 (Cth), this structure offers credibility, protection, and growth opportunities.

- Limited liability protects owners.

- Easier to attract investors and finance.

- Continues even if ownership changes.

- Professional and trustworthy image.

- Clear separation between owners and management.

- Expensive and time-consuming to set up.

- Strict reporting and compliance rules.

- Company profits taxed separately.

- Less privacy (public ASIC records).

- Directors carry legal responsibilities.

Legal Pathways is a Perth law firm set up as a Private Company.

🌱Not-for-Profit Organisation

Definition:

A not-for-profit organisation (NFP) exists to achieve a social, cultural, or community purpose, not to make profits for owners.

Summary:

Common examples in WA include Surf Life Saving WA, charities, and community sports clubs. These organisations can generate income but must reinvest all surplus funds into their mission. Many NFPs register as incorporated associations under the Associations Incorporation Act 2015 (WA) and may qualify for tax exemptions or government grants. They often rely on volunteers and donations, meaning financial stability and strong governance are essential.

- Focused on community or environmental goals.

- Eligible for grants, tax concessions, and donations.

- Builds strong public trust and support.

- Encourages volunteering and civic engagement.

- Long-term community impact.

- Complicated reporting and legal requirements.

- Relies heavily on external funding.

- Limited ability to pay competitive wages.

- Slow decision-making due to boards/committees.

- Difficult to scale operations.

Cottesloe Surf Life Saving — example of a WA not-for-profit community organisation.

🍔Franchise

Definition:

A franchise is an agreement where a person (the franchisee) buys the right to operate under another business’s brand and systems.

Summary:

Franchising is popular in WA — think Subway, Boost Juice, Jim’s Mowing. It offers brand recognition but limited independence. Regulated by the Franchising Code of Conduct under the ACCC.

- Well-known brand and established reputation.

- Comprehensive training and marketing support.

- Easier to access finance.

- National marketing attracts customers.

- Part of a larger business network.

- High start-up and royalty costs.

- Limited independence and creativity.

- Must follow strict franchisor rules.

- Reputation depends on other outlets.

- Difficult to exit a franchise agreement.

Summary Table

| Business Type | Ownership | Liability | Control | Example |

|---|---|---|---|---|

| Sole Trader | One person | Unlimited | Full | Local café owner |

| Partnership | 2–20 people | Unlimited (shared) | Shared | Medical or Accounting firm |

| Private Company | 1–50 shareholders | Limited | Directors/shareholders | Legal Pathways |

| Not-for-Profit | Members or board | Limited | Committee or board | Surf Life Saving WA |

| Franchise | Franchisee & franchisor | Varies | Shared | Subway, Jim’s Mowing |